In a market sector often defined by impatience and ‘up-only’ demands, Story Protocol co-founder S.Y. Lee has taken a contrarian stance: slower is better. Addressing the recent controversy surrounding delayed token unlocks, Lee defended the decision to extend vesting cliffs.

His argument? Premature liquidity often strangles protocol development before it achieves escape velocity. In a recent interview with CoinDesk, Lee pointed to Worldcoin’s extended lockups as a successful precedent, suggesting that longer runways prevent the rampant sell pressure that historically capsizes early-stage infrastructure projects.

That signals a fundamental shift in how crypto capital creates value. The era of ‘fair launch’ farming, where liquidity is mercenary and fleeting, is giving way to high-conviction retention models. Lee’s defense highlights a crucial friction point: retail traders want immediate access, but sustainable ecosystems require entrenched capital. By prioritizing long-term alignment over short-term liquidity events, Story is betting that patience pays a higher yield than speed.

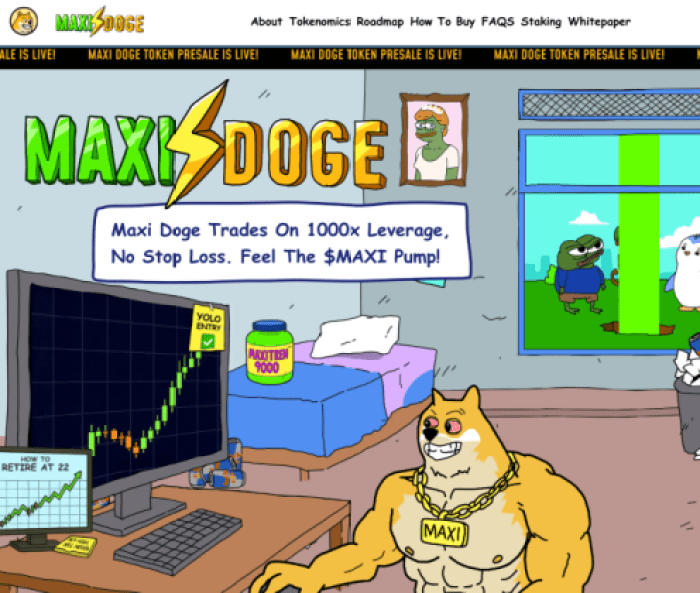

This pivot toward strength accumulation rather than quick exits isn’t isolated to infrastructure layers. It’s beginning to permeate the high-octane world of meme coins, where community conviction is the only true fundamental. While Story locks up tokens to build IP rails, a new contender, Maxi Doge, is locking in value through a culture of ‘1000x leverage’ mentality and heavy staking incentives.

Just as Story demands patience for protocol health, Maxi Doge ($MAXI) demands grit for portfolio health, positioning itself as the counter-narrative to low-effort, low-reward trading.

Maxi Doge Brings ‘Never Skip Leg Day’ Mentality to Meme Sector

While Story Protocol focuses on intellectual property, Maxi Doge effectively tokenizes market resilience. The project operates under a distinct philosophy: ‘Never skip leg day, never skip a pump.’

In a sector cluttered with derivative dog coins that collapse at the first sign of volatility, $MAXI is engineered to mirror the psychology of high-conviction traders. It addresses a specific retail pain point, the lack of whale-sized conviction, by gamifying the holding process through a culture of strength and heavy leverage.

The project differentiates itself through its planned utility that reinforces holding behavior. Future features like holder-only trading competitions and a ‘Maxi Fund’ treasury are designed to deepen liquidity rather than drain it.

The ‘Leverage King’ culture isn’t just marketing fluff; it’s a mechanism to filter out weak hands. It creates a community base that mirrors the long-term alignment S.Y. Lee advocates for at the protocol level. By integrating viral gym-bro humor with actual financial incentives, the project creates a feedback loop where community engagement directly correlates with token stability.

Plus, the ecosystem includes planned partner events with futures platform integrations, allowing top ROI hunters to compete for leaderboard rewards. That turns passive holding into active participation. The risk here for casual observers? Dismissing the aesthetic as pure satire.

Beneath the ‘beefcake’ branding lies a structured economy designed to outperform the original $DOGE by rewarding those who grind through the bear and bull cycles alike.

EXPLORE THE HEAVYWEIGHT DIVISION AT MAXI DOGE

Whale Activity and Staking Rewards Signal High Conviction

The market’s appetite for this high-conviction model is visible in the on-chain data. Maxi Doge has raised over $4.5M. That significant figure suggests retail and institutional interest is coalescing around the project before it hits open markets. With tokens currently priced at $0.0002803, early entrants are positioning themselves ahead of the public listing, betting on the project’s ability to capture the ‘gym-bro’ meme niche. If you want to know more check out our ‘What is Maxi Doge?‘ guide.

Smart money seems to be validating this thesis. On-chain data from Etherscan shows 2 whale wallets each accumulated $314K. Although not a sign of success, this level of capital injection during a presale phase is rare for standard meme coins and implies that sophisticated actors see value beyond the hype.

To lock in this capital, Maxi Doge uses a dynamic staking APY, with daily planned automatic smart contract distributions derived from a 5% staking allocation pool. This setup mirrors the delayed gratification model defended by Story Protocol’s founders, rewarding users who commit their assets to the network for up to one year. By incentivizing a lock-up of supply, the project aims to reduce sell pressure on launch day, creating a firmer floor price than competitors relying solely on viral momentum.

CHECK OUT THE $MAXI PRESALE

This article is for informational purposes only and does not constitute financial advice. Cryptocurrencies are high-risk assets; invest only what you can afford to lose.